41 how to find the coupon rate of a bond

What Is a Coupon Rate? - Investment Firms A bond's coupon rate shows you how much interest the bond issuer pays the bondholder annually. Therefore, this rate is measured as a percentage of bond par value (face value). For instance, assume a $2,000 bond has a face value of $2,000 and a coupon rate of 2%, this means that $40 (that is 2% of $2,000) will be paid to the bondholder each year till its maturity. Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia A bond's coupon rate is expressed as a percentage of its par value. The par value is simply the face value of the bond or the value of the bond as stated by the issuing entity. Thus, a $1,000 bond...

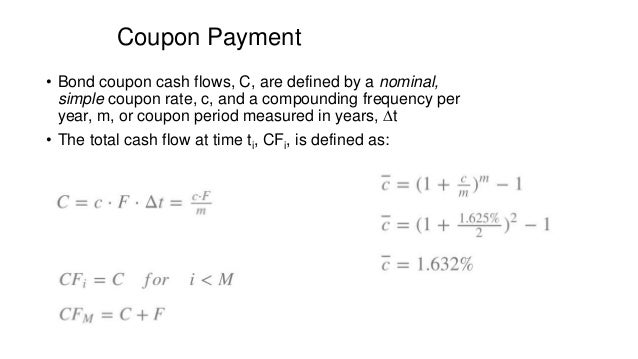

How to Calculate the Price of a Bond With Semiannual Coupon Interest ... To convert this to a coupon payment, or the amount of money you'd actually receive each period, multiply the face amount of the bond by the required rate of return. Continuing with the example, if the face value was $1,000, you'd multiply it by 0.025. This results in a semiannual payment of $25. Discounting Future Payment to Present Values

How to find the coupon rate of a bond

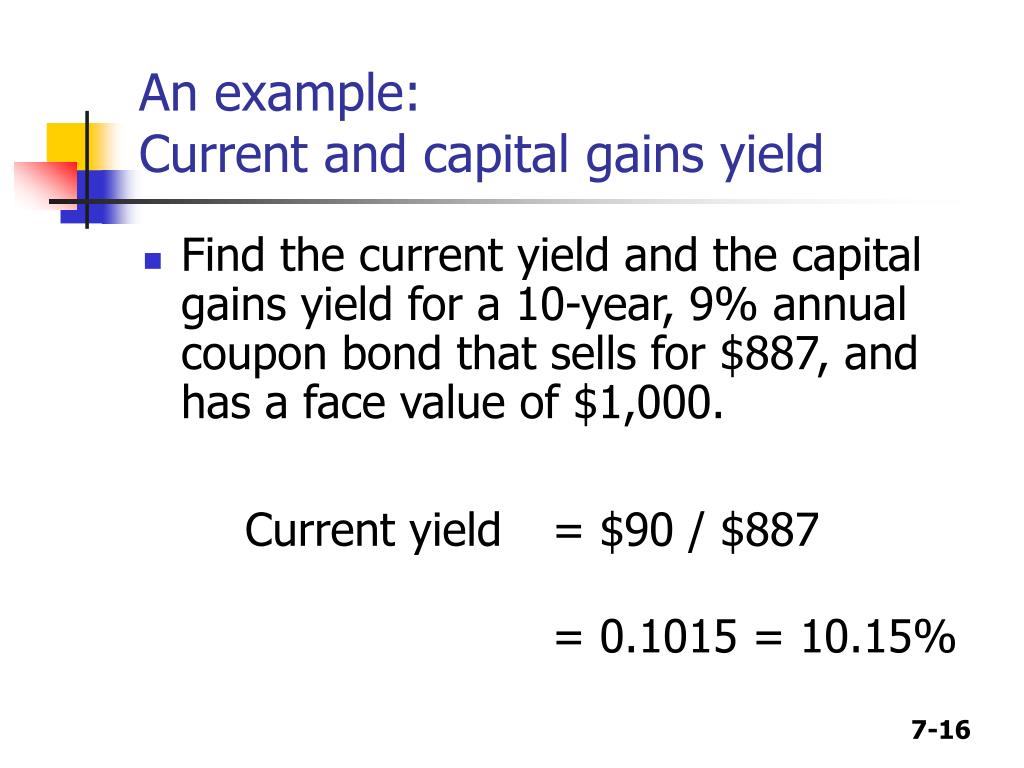

What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. Coupon Rate Calculator | Bond Coupon You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value. For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate calculator to estimate the result in no time! Coupon Rate: Formula and Bond Nominal Yield Calculator [Excel Template] The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000

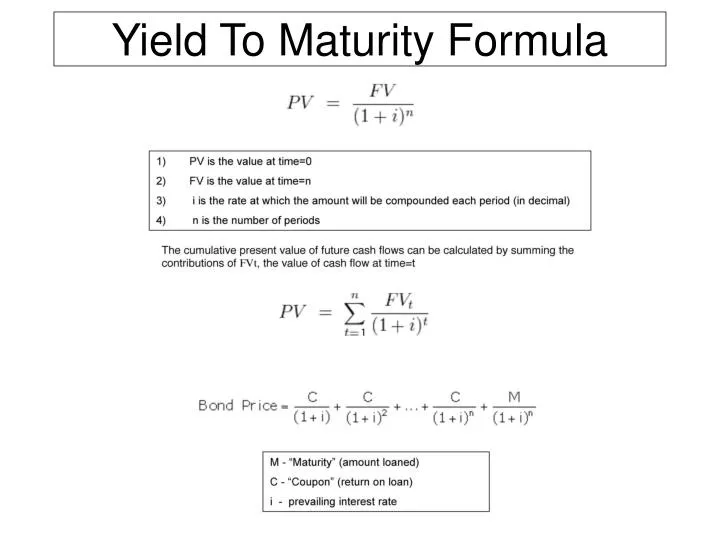

How to find the coupon rate of a bond. How do I Calculate Zero Coupon Bond Yield? - Smart Capital Mind The zero coupon bond yield is easier to calculate because there are fewer components in the present value equation. It is given by Price = (Face value)/ (1 + y) n, where n is the number of periods before the bond matures. This means that you can solve the equation directly instead of using guess and check. The yield is thus given by y = (Face ... How can I calculate a bond's coupon rate in Excel? In cell B2, enter the method "=A3/B1" to yield the annual coupon rate of your bond in decimal kind. Finally, choose cell B2 and hit CTRL+SHIFT+% to use proportion formatting. For instance, if a bond has a par worth of $1,000 and generates two $30 coupon funds annually, the coupon rate is ($30 x 2) ÷ $1,000, or zero.06. Bond Price Calculator Coupon rate is the annual rate of return the bond generates expressed as a percentage from the bond's par value. Coupon rate compounding frequency that can be Annually, Semi-annually, Quarterly si Monthly. Market interest rate represents the return rate similar bonds sold on the market can generate. This figure is used to see whether the bond ... What is the Coupon Rate? - Realonomics Meanwhile, the interest rate changes its rate according to the bond yields. The coupon rate is the annual rate of the bond that has to be paid to the holder. What is the coupon rate on a 10 year treasury? Treasury Yields. Name Coupon Yield; GT2:GOV 2 Year: 1.50: 1.93%: GT5:GOV 5 Year: 1.88: 2.15%: GT10:GOV 10 Year: 1.88: 2.16%: GT30:GOV 30 Year:

Zero Coupon Bond Yield - Formula (with Calculator) - finance formulas The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as. This formula will then become. By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top. How to Calculate the Bond Duration (example included) Therefore, for our example, m = 2. Here is a summary of all the components that can be used to calculate Macaulay duration: m = Number of payments per period = 2. YTM = Yield to Maturity = 8% or 0.08. PV = Bond price = 963.7. FV = Bond face value = 1000. C = Coupon rate = 6% or 0.06. Additionally, since the bond matures in 2 years, then for ... Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% Coupon Bond - Guide, Examples, How Coupon Bonds Work The formula is: Where: c = Coupon rate i = Interest rate n = number of payments Also, the slightly modified formula of the present value of an ordinary annuity can be used as a shortcut for the formula above, since the payments on this type of bond are fixed and set over fixed time periods: More Resources

How to Calculate Bond Discount Rate: 14 Steps (with Pictures) - wikiHow Divide the annual coupon rate by the number of payments per year. In the above example, the annual coupon rate is 10 percent. The number of interest payments per year is two. The interest rate for each payment is 5 percent . 3 Calculate the amount of each interest payment. Multiply the principal of the bond by the interest rate per period. Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100. Coupon Rate = (20 / 100) * 100. Coupon Rate = 20%. Now, if the market rate of interest is lower than 20% than the bond will be traded at a premium as this bond gives more value to the investors compared to other fixed income securities. How to Calculate a Coupon Payment: 7 Steps (with Pictures) - wikiHow Step 1, Get the bond's face value. The first piece of information is the actual face value of the bond, sometimes called its par value.[2] X Research source Note that this value might be (and probably is) different from what you paid for the bond. It's given to you by your broker.Step 2, Locate the bond expiration. You'll also need to locate the bond expiration or maturity date.[3] X Research source That way, you can get a sense of how long you'll be receiving coupons and when you can expect ... Singapore Savings Bond coupon rates for 1st-year at 2.6%; 10-year ... THE 10-year average return for the October issue of the Singapore Savings Bond (SSB) that opened on Thursday (Sep 1) is 2.75 per cent while the first-year interest rate is at 2.6 per cent - both lower than September's issue. Read more at The Business Times.

Coupon Rate of a Bond - WallStreetMojo The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

Coupon Bond Formula | Examples with Excel Template - EDUCBA Calculate the market price of the bonds based on the given information. Solution: Coupon (C) is calculated using the Formula given below. C = Annual Coupon Rate * F C = 5% * $1000 C = $50 Coupon Bond is calculated using the Formula given below. Coupon Bond = C * [1 - (1+Y/n)-n*t/ Y ] + [ F/ (1+Y/n)n*t]

Calculate Price of Bond using Spot Rates | CFA Level 1 - AnalystPrep Sometimes, these are also called "zero rates" and bond price or value is referred to as the "no-arbitrage value." Calculating the Price of a Bond Using Spot Rates. Suppose that: the 1-year spot rate is 3%; the 2-year spot rate is 4%; and; the 3-year spot rate is 5%. The price of a 100-par value 3-year bond paying 6% annual coupon ...

How to Value a Bond Using Forward Rates - Finance Train Say, a bond is going to pay $100 as coupon after 2 years. s 2 is the 2-year spot rate is 6%. The present value of this cash flow will be: PV of $100 = $100/ (1+s 2) 2 We also know that (1+s 2) 2 = (1+s 1) (1+ 1 f 1) Replacing this is the PV calculation: PV of $100 = $100/ (1+s 1) (1+ 1 f 1) If s1 is 6% and 1 f 1 is 7%.

What Is the Coupon Rate of a Bond? - The Balance The formula to calculate a bond's coupon rate is very straightforward, as detailed below. The annual interest paid divided by bond par value equals the coupon rate. As an example, let's say the XYZ corporation issues a 20-year bond with a par value of $1,000 and a 3% coupon rate.

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816) The present value of the cash flow from the bond is 816, this is what the investor should be prepared to pay for this bond if the discount rate is 7%.

How to Find the Interest Rate on a Bond Look up the price you paid for the bond in your financial records. Divide the coupon rate in dollars by the purchase price of the bond and multiply the result by 100 to convert to a percentage interest rate. Suppose you paid $4,500 for a bond with face value of $5,000 and a coupon rate of $300. You have ($300/$4,500) * 100 = 6.67 percent.

Calculate the Coupon Rate of a Bond - YouTube 33,837 views Jul 25, 2018 This video explains how to calculate the coupon rate of a bond when you are given all of the other terms (price, maturity, par value, and YTM) with the bond prici ...more...

How Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia In cell B2, enter the formula "=A3/B1" to yield the annual coupon rate of your bond in decimal form. Finally, select cell B2 and hit CTRL+SHIFT+% to apply percentage formatting. For example, if a...

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The issuer makes periodic interest payments until maturity when the bondholder's initial investment - the face value (or "par value") of the bond - is returned to the bondholder. Formula for Calculating the Coupon Rate Where: C = Coupon rate i = Annualized interest P = Par value, or principal amount, of the bond Download the Free Template

Coupon Rate: Formula and Bond Nominal Yield Calculator [Excel Template] The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000

Coupon Rate Calculator | Bond Coupon You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value. For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate calculator to estimate the result in no time!

What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

:max_bytes(150000):strip_icc()/bond_duration-5bfc37fd46e0fb00260e7d1c.jpg)

Post a Comment for "41 how to find the coupon rate of a bond"