38 coupon rate for bonds

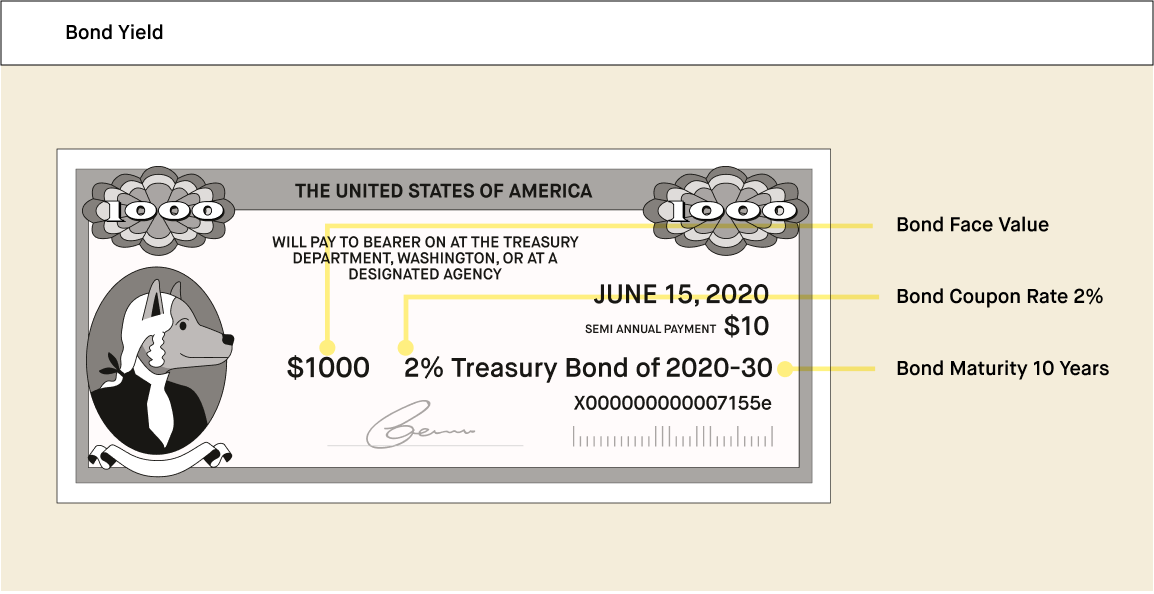

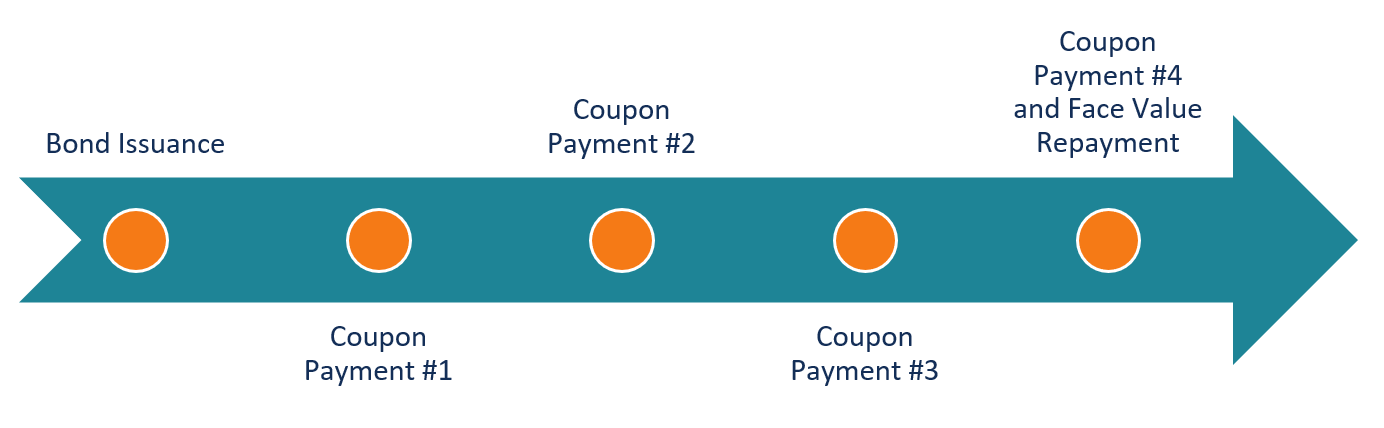

Understanding Coupon Rate and Yield to Maturity of Bonds To translate this to quarterly payment, first, multiply the Coupon Rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. Here's a sample of how you can compute your expected coupon income from your bond: Php 4,750.00 is the income you can expect to receive quarterly. US Treasury Bonds - Fidelity US Treasury floating rate notes (FRNs) $1,000: Coupon: 2 years: Interest paid quarterly based on discount rates for 13-week treasury bills, principal at maturity: Treasury STRIPS: $1,000: Discount: ... Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. ...

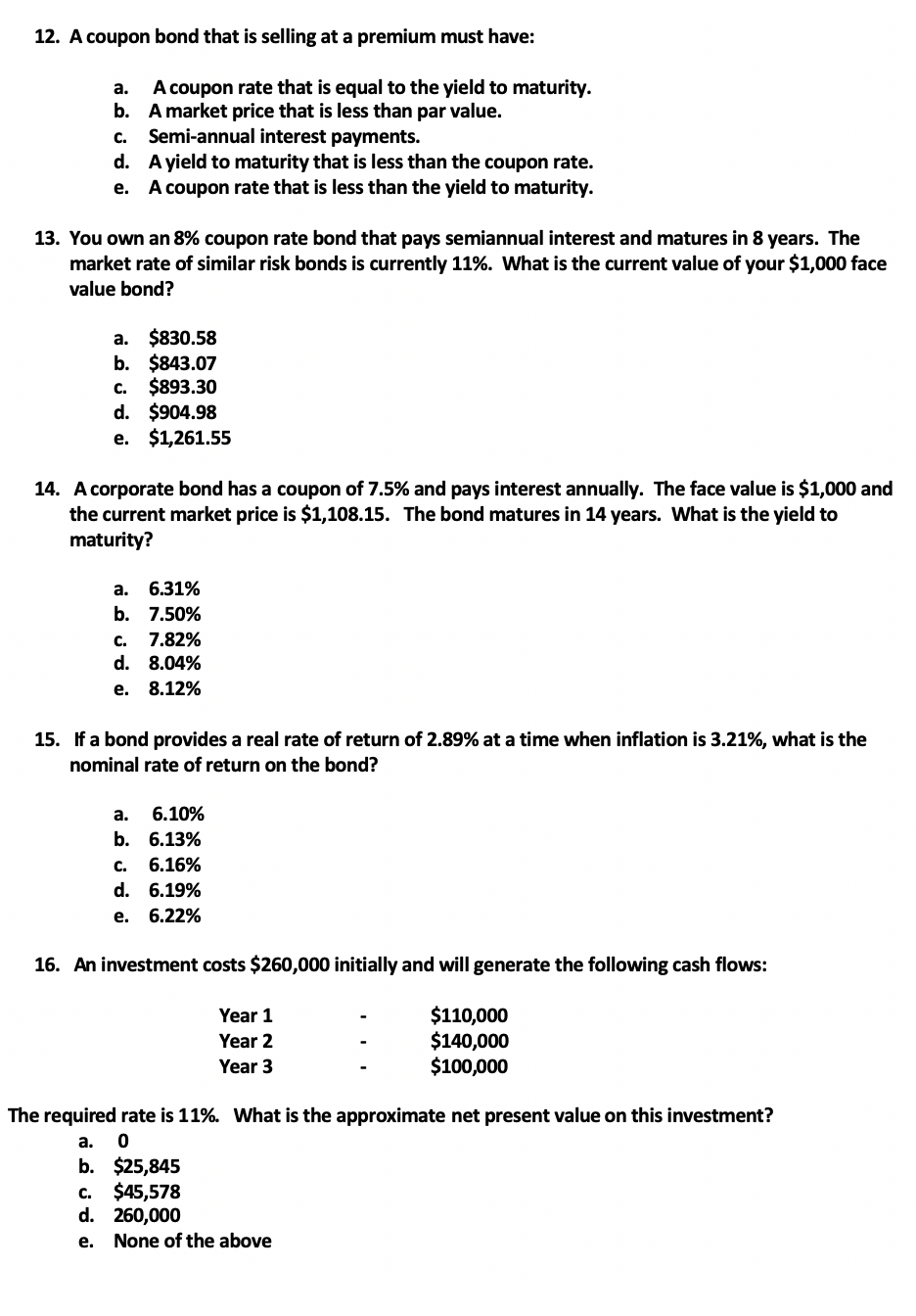

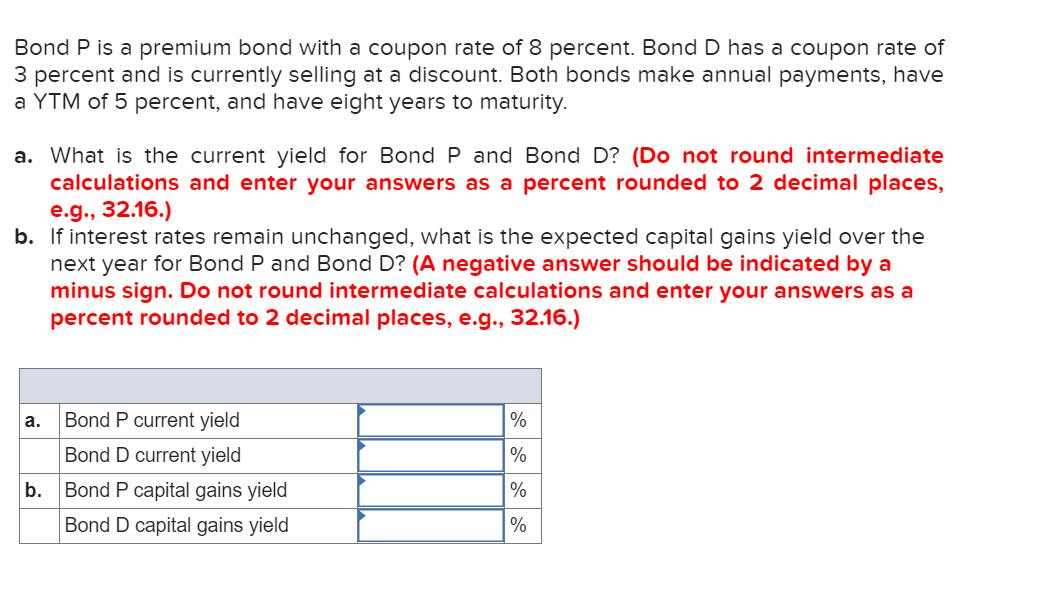

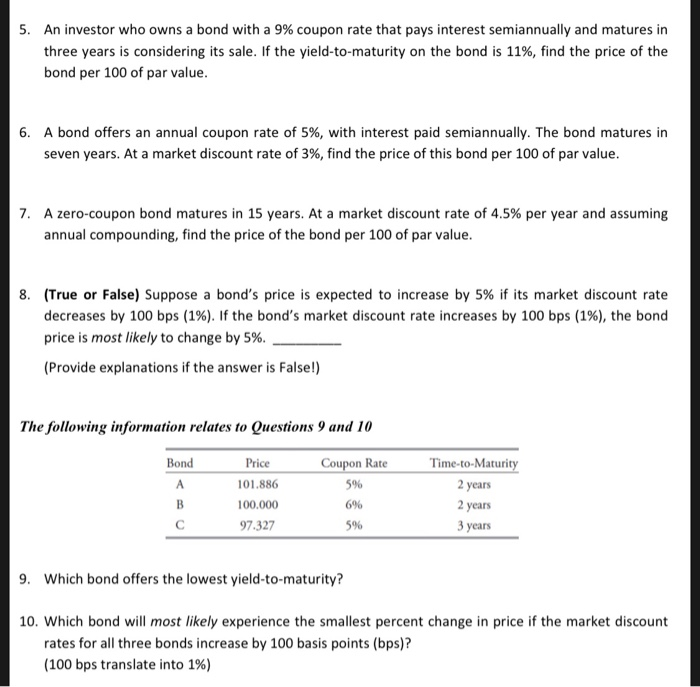

King noodles bonds have a 9 coupon rate interest is 37. King Noodles' bonds have a 9% coupon rate. Interest is paid quarterly and the bonds have amaturity of 10 years. If the appropriate discount rate is 10% on similar bonds, what is the price of King Noodles' bonds?A) $937.24 B) $938.55.

Coupon rate for bonds

› articles › bondsUnderstanding Bond Prices and Yields - Investopedia Jun 28, 2007 · A bond's coupon rate is the periodic distribution the holder receives. ... In secondary markets, bonds may be sold for a premium or discount on their face value. Therefore, although you might've ... Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia May 20, 2022 · Though bonds may be issued with variable rates tied to LIBOR, most bonds are issued with a fixed rate, causing the coupon rate and yield to often be different. 1:21 Comparing Yield To Maturity And ... Fixing of coupon rates - Nykredit Realkredit A/S Effective from 7 October 2022, the coupon rates of floating-rate bonds issued by Nykredit Realkredit A/S will be adjusted. Bonds with quarterly interest rate fixing The new coupon rates will apply ...

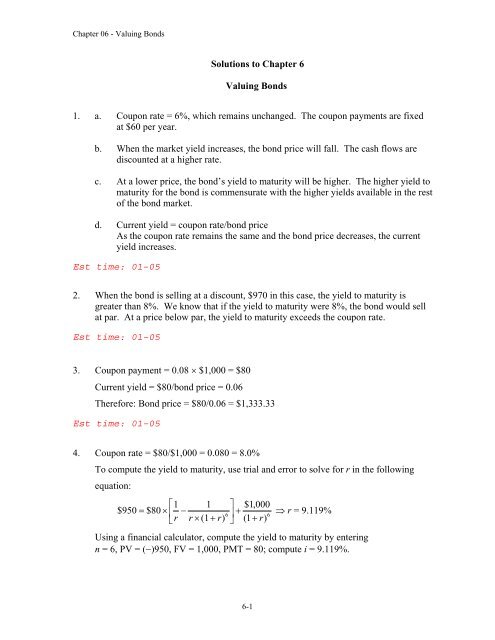

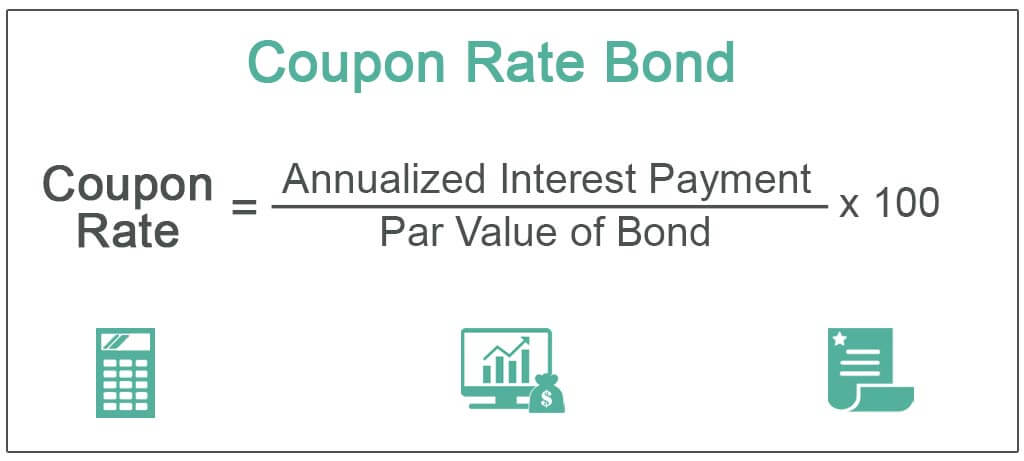

Coupon rate for bonds. Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon Rate The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, home.treasury.gov › interest-rate-statisticsInterest Rate Statistics | U.S. Department of the Treasury Sep 30, 2010 · To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data Coupon Bond - Guide, Examples, How Coupon Bonds Work Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay $5 in annual interest to investors for every bond purchased. After four years, on the bond's maturity date, Apple will make its last coupon payment. corporatefinanceinstitute.com › coupon-rateCoupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

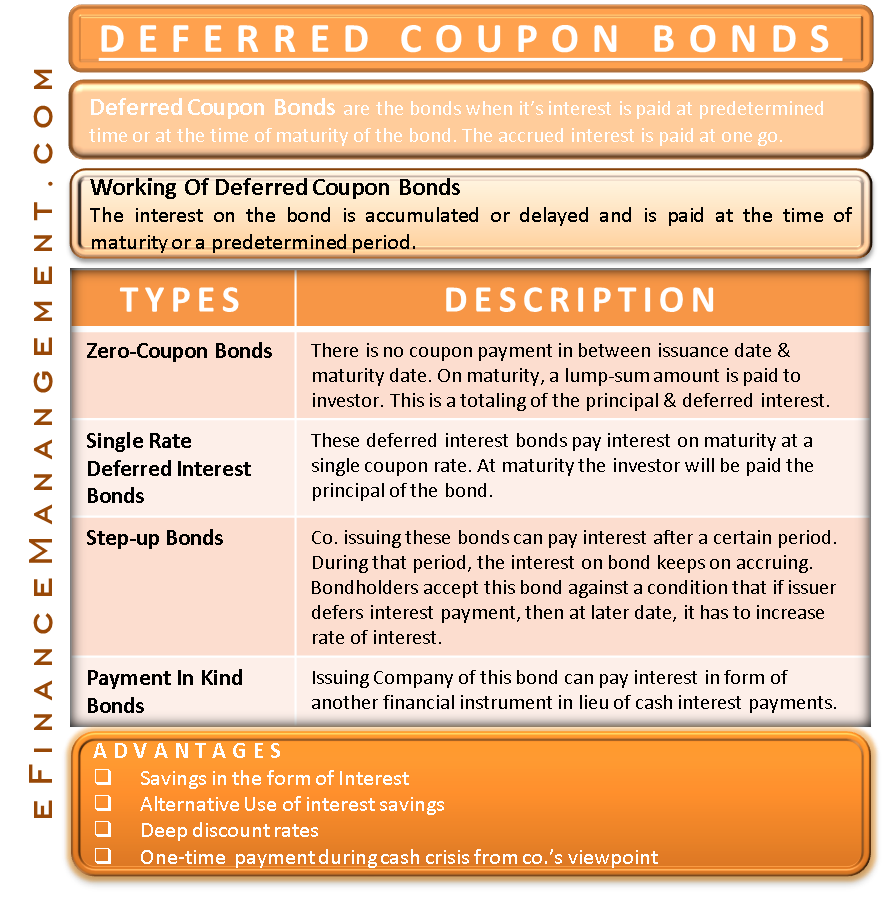

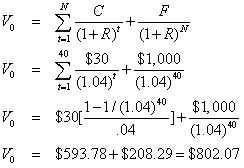

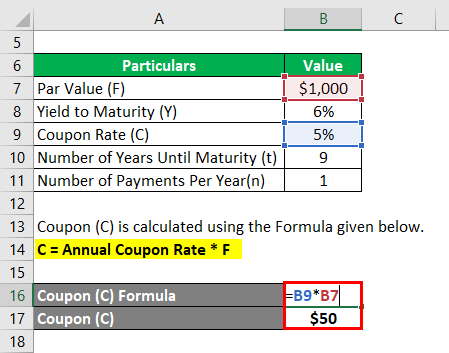

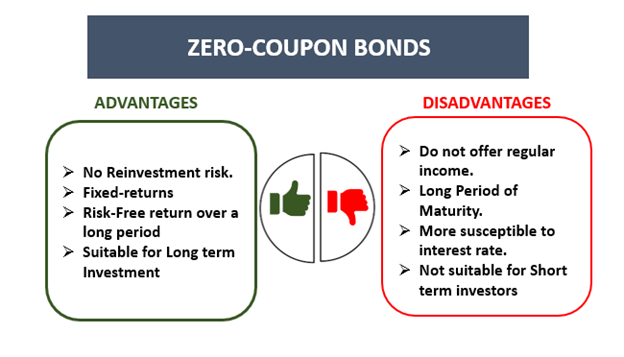

How Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia Jul 28, 2022 · A bond's coupon rate is simply the rate of interest it pays each year, expressed as a percentage of the bond's par value. (It's called the coupon rate because, in days of yore, investors actually ... Understanding Pricing and Interest Rates — TreasuryDirect Treasury bonds are issued in terms of 20 years and 30 years and are offered in multiples of $100. Price and Interest The price and interest rate of a bond are determined at auction. The price may be greater than, less than, or equal to the bond's par amount (or face value). (See rates in recent auctions .) Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Mar 04, 2022 · The coupon rate represents the actual amount of interest earned by the bondholder annually, ... Zero-Coupon Bonds. A zero-coupon bond is a bond without coupons, and its coupon rate is 0%. The issuer only pays an amount equal to the face value of the bond at the maturity date. Instead of paying interest, the issuer sells the bond at a price less ... Coupon Bond | Coupon Bond Price | Examples of Coupon Bond - EDUCBA Let us take the example of a debt raised by ASD Inc. in the form of a bond that pays coupons annually. The par value of the bond is $1,000, coupon rate is 5% and number of years until maturity is 10 years. Determine the price of the CB if the yield to maturity is 4%. Given,Par value, P = $1,000 Coupon, C = 5% * $1,000 = $50

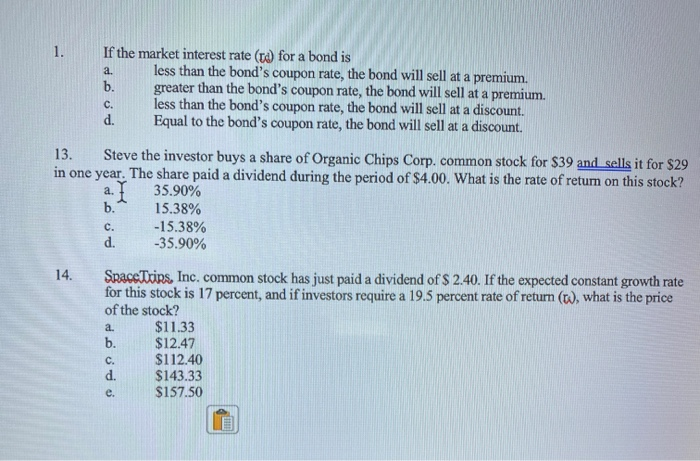

Interest Rate Statistics | U.S. Department of the Treasury Sep 30, 2010 · To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data Bond Coupon Interest Rate: How It Affects Price - Investopedia Dec 18, 2021 · The coupon rate on a bond vis-a-vis prevailing market interest rates has a large impact on how bonds are priced. If a coupon is higher than the prevailing interest rate, the bond's price rises; if ... Treasury Bond (T-Bond) - Overview, Mechanics, Example Treasury Bond Example. Current Yield = 1 Year Coupon Payment / Bond Price = $25 / $950 = 2.63%. The yield to maturity (YTM) is essentially the internal rate of return (IRR) earned by an investor who holds the bond until maturity, assuming all coupon payments are made as scheduled and reinvested at the same rate. Bond Coupon Interest Rate: How It Affects Price - Investopedia A bond's coupon rate denotes the amount of annual interest paid by the bond's issuer to the bondholder. Set when a bond is issued, coupon interest rates are determined as a percentage of the bond's...

How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia Sep 23, 2022 · The yield to maturity for zero-coupon bonds is also known as the spot rate. ... Zero-coupon bonds often mature in ten years or more, so they can be long-term investments. The lack of current ...

Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity...

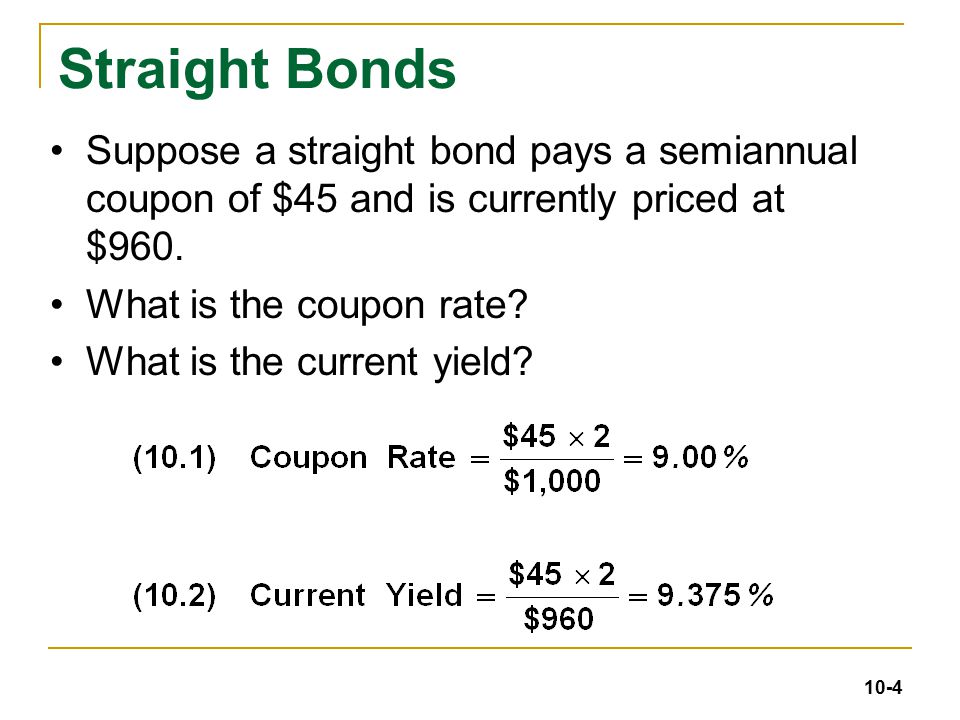

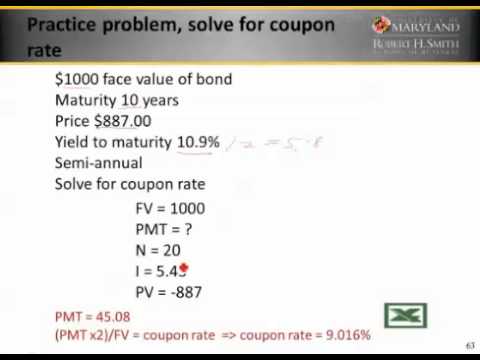

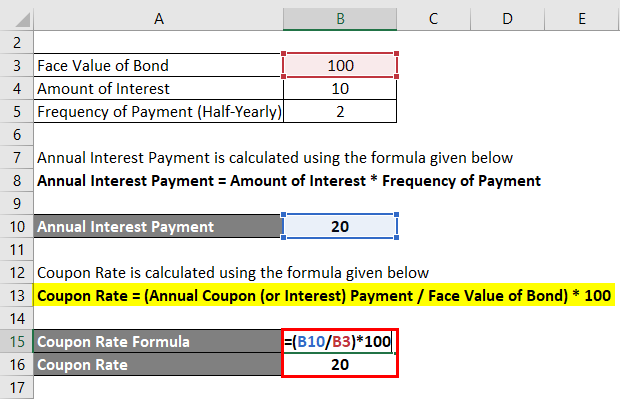

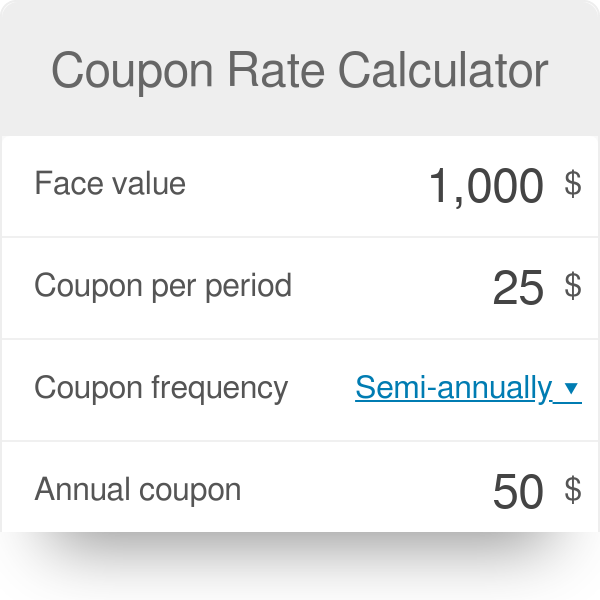

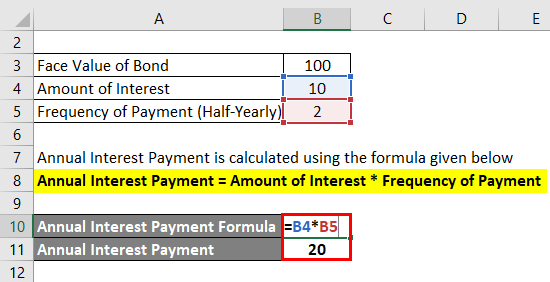

Coupon Rate Formula | Step by Step Calculation (with Examples) Do the Calculation of the coupon rate of the bond. Annual Coupon Payment Annual coupon payment = 2 * Half-yearly coupon payment = 2 * $25 = $50 Therefore, the calculation of the coupon rate of the bond is as follows - Coupon Rate of the Bond will be - Example #2 Let us take another example of bond security with unequal periodic coupon payments.

› ask › answersHow Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia Jul 28, 2022 · A bond's coupon rate is simply the rate of interest it pays each year, expressed as a percentage of the bond's par value. (It's called the coupon rate because, in days of yore, investors actually ...

Coupon Rate - Meaning, Calculation and Importance - Scripbox To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%. Importance of Coupon Rate in Bonds Bonds pay interest to their holders.

en.wikipedia.org › wiki › Coupon_(finance)Coupon (finance) - Wikipedia Zero-coupon bonds are those that pay no coupons and thus have a coupon rate of 0%. Such bonds make only one payment: the payment of the face value on the maturity date. Normally, to compensate the bondholder for the time value of money, the price of a zero-coupon bond will always be less than its face value on any date

What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

Fixing of coupon rates - Nykredit Realkredit A/S The new coupon rates will apply from 10 October 2022 to 9 January 2023: Uncapped bonds DK0030505805, (SNP), maturity in 2024, new rate as at 10 October 2022: 2.2480% pa

Bond (finance) - Wikipedia The coupon is the interest rate that the issuer pays to the holder. For fixed rate bonds, the coupon is fixed throughout the life of the bond. For floating rate notes, the coupon varies throughout the life of the bond and is based on the movement …

Coupon Rate Calculator | Bond Coupon coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate calculator to estimate the result in no time! What is the difference between bond coupon rate and yield to maturity (YTM)?

Bond: Financial Meaning With Examples and How They Are Priced Jul 01, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ...

Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · A bond's coupon rate is the periodic distribution the holder receives. ... In secondary markets, bonds may be sold for a premium or discount on their face value. Therefore, although you might've ...

What is a Coupon Rate? - Definition | Meaning | Example Other bonds may pay interest every three months. In order to calculate the coupon rate formula of a bond, we need to know: the face value of the bond, the annual coupon rate, and the number of periods per annum. Let's look at an example. Example. The coupon payment on each bond is $1,000 x 8% = $80.

› terms › bBond: Financial Meaning With Examples and How They Are Priced Jul 01, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ...

Coupon Bond - Investopedia The coupon rate is calculated by taking the sum of all the coupons paid per year and dividing it with the bond's face value. Real-World Example of a Coupon Bond If an investor purchases a $1,000...

› ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · Though bonds may be issued with variable rates tied to LIBOR, most bonds are issued with a fixed rate, causing the coupon rate and yield to often be different. 1:21 Comparing Yield To Maturity And ...

What Is the Coupon Rate of a Bond? - The Balance ABC bond's coupon rate was 3%, based on a par value of $1,000 for the bond. This translates to $30 of interest paid each year. Let's say Investor 1 purchases the bond for $900 in the secondary market but still receives the same $30 in interest. This translates to a current yield of 3.33%.

Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond.. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value.For example, if a bond has a face value of $1,000 and a coupon rate of 5%, …

Fixing of coupon rates - Nykredit Realkredit A/S Effective from 7 October 2022, the coupon rates of floating-rate bonds issued by Nykredit Realkredit A/S will be adjusted. Bonds with quarterly interest rate fixing The new coupon rates will apply ...

Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia May 20, 2022 · Though bonds may be issued with variable rates tied to LIBOR, most bonds are issued with a fixed rate, causing the coupon rate and yield to often be different. 1:21 Comparing Yield To Maturity And ...

› articles › bondsUnderstanding Bond Prices and Yields - Investopedia Jun 28, 2007 · A bond's coupon rate is the periodic distribution the holder receives. ... In secondary markets, bonds may be sold for a premium or discount on their face value. Therefore, although you might've ...

Post a Comment for "38 coupon rate for bonds"