43 zero coupon bonds definition

What is a Zero-Coupon Bond? Definition, Features, Advantages ... Definition: A zero-coupon bond, as the name suggests, it is a financial instrument which does not allow a regular interest payment to the investor. Moreover, it is a bond which is issued at a meagre market price (discounted price) in comparison to its face value. And it is redeemable on or after a specified maturity date at the par value itself. Convertible Bonds: Definition and Example Calculation Where: C is coupon value, r is rate, n is year and CV is conversion value. Example: ABC Co has issued 100,000 units of convertible bonds with a nominal value of US$100 each. The coupon rate of the bonds is 10% payable annually. Each of the US$100 convertible bonds can be converted into 50 ordinary shares in three years’ time. If any bonds are ...

Bond Definition & Meaning - Merriam-Webster bond: [verb] to lap (a building material, such as brick) for solidity of construction.

Zero coupon bonds definition

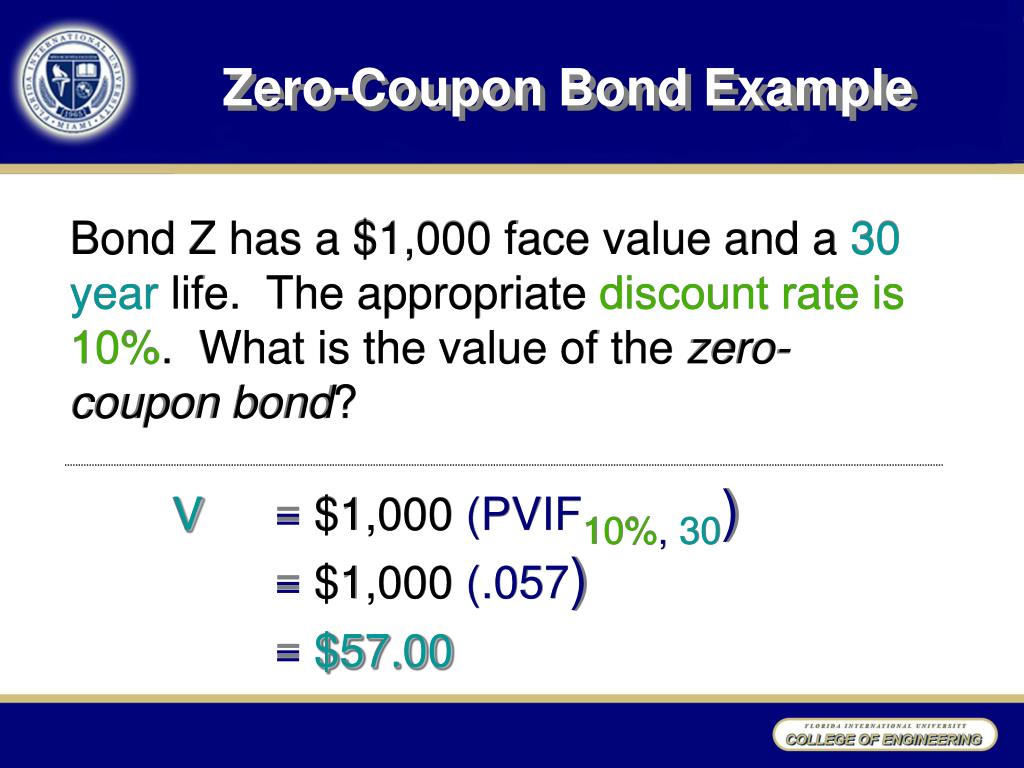

What Is a Zero-Coupon Bond? Definition, Characteristics & Example Like regular bonds, zero-coupon bonds are financial securities that mature over time, and their face (par) value is paid to their holder at the end of their term. Unlike coupon-paying bonds,... Zero-coupon bond financial definition of Zero-coupon bond Zero-Coupon Bond A bond that pays no interest. It is sold at a discount from par and matures at par. These are fairly illiquid investments because they do not benefit from changes in interest rates. However, they tend to be low- risk. Zero-coupon bonds fluctuate in price, sometimes dramatically, with changes in interest rates. Bond Definition: What Are Bonds? – Forbes Advisor 24.08.2021 · Zero-Coupon Bonds: As their name suggests, zero-coupon bonds do not make periodic interest payments. Instead, investors buy zero-coupon bonds at a discount to their face value and are repaid the ...

Zero coupon bonds definition. Zero Coupon Bonds Explained (With Examples) - Fervent Zero Coupon Bonds, aka "Deep Discount Bonds", or "ZCBs" are bonds (a type of debt instrument) that don't pay any coupons (aka interest). In other words, there is no coupon payment (aka interest payment). They pay a zero coupon. Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest and trades at a discount to its face value. It is also called a pure discount bond or deep discount bond. U.S. Treasury bills are an example of a zero-coupon bond. Zero-coupon bonds - definition of Zero-coupon bonds by The Free Dictionary Zero-coupon bonds synonyms, Zero-coupon bonds pronunciation, Zero-coupon bonds translation, English dictionary definition of Zero-coupon bonds. Noun 1. zero-coupon bond - a bond that is issued at a deep discount from its value at maturity and pays no interest during the life of the bond; the... Zero-Coupon Bond - Definition, How It Works, Formula 28.01.2022 · Understanding Zero-Coupon Bonds. As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money.. The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future – an investor would prefer to receive $100 today …

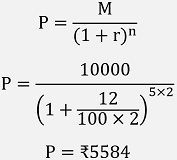

Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond (Also known as Pure Discount Bond or Accrual Bond) refers to those bonds which are issued at a discount to its par value and makes no periodic interest payment, unlike a normal coupon-bearing bond. In other words, its annual implied interest payment is included in its face value which is paid at the maturity of such bond. Zero Coupon Covered Bonds Definition | Law Insider Define Zero Coupon Covered Bonds. means Covered Bonds which will be offered and sold at a discount to their nominal amount and which will not bear interest. Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Zero coupon bonds are bonds that do not make any interest payments until maturity, you won't put a single penny of interest in your pocket for two decades. Zero-Coupon Bond Definition - Investopedia 31.05.2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

Zero-Coupon Bonds: Definition, Formula, Example ... - CFAJournal A zero-coupon bond can be described as a financial instrument that does not render interest. They normally trade at high discounts, and offer full face par value, at the time of maturity. The spread between the purchase price of the bond and the price that the bondholder receives at maturity is described as the profit of the bondholder. Zero Coupon Bond (Definition, Formula, Examples, Calculations) Basis Zero-Coupon Bond Regular Coupon Bearing Bond; Meaning: It refers to fixed Income Fixed Income Fixed Income refers to those investments that pay fixed interests and dividends to the investors until maturity. Government and corporate bonds are examples of fixed income investments. read more security, which is sold at a discount to its Par value and doesn’t involve … Coupon Definition - Investopedia 02.04.2020 · Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value. Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years.

Zero-Coupon Bond Definition - Investopedia A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for...

What Is a Zero-Coupon Bond? Definition, Advantages, Risks A zero-coupon bond doesn't pay periodic interest, but instead sells at a deep discount, paying its full face value at maturity. Zeros-coupon bonds are ideal for long-term, targeted financial needs...

What is a Zero Coupon Bond? - Definition | Meaning | Example A Zero coupon bond is a bond that sells without a stated rate of interest. This way the company or government doesn't have to worry about changing interest rates. These bonds are sold at a discount don't pay a standard monthly interest percentage like normal bonds do. Instead, investors receive the gain of the appreciated bond at maturity.

Zero Coupon Bonds - definition of Zero Coupon Bonds by The Free Dictionary zero-coupon bond - a bond that is issued at a deep discount from its value at maturity and pays no interest during the life of the bond; the commonest form of zero-coupon security zero coupon bond governing , government activity , government , governance , administration - the act of governing; exercising authority; "regulations for the governing of state prisons"; "he had considerable experience of government"

Zero-Coupon Bond - Definition, How It Works, Formula A Zero-Coupon Bond also called a pure discount bond or deep discount bond is a debt instrument that does not make any interest payment during the bond's tenure. These bonds are issued at a discount to their par value and investors earn profit from the difference of the par value and discounted purchase price when the bond reaches its maturity.

Accounting for Bonds | Premium | Discount | Example Accounting for Bonds Definition. Bonds Payable is the promissory note which the company uses to raise funds from the investor. Company sells bonds to the investors and promise to pay the annual interest plus principal on the maturity date. It is the long term debt which issues by the company, government, and other entities. It must be ...

Zero-coupon bonds - definition of Zero-coupon bonds by The Free Dictionary Zero-coupon bonds synonyms, Zero-coupon bonds pronunciation, Zero-coupon bonds translation, English dictionary definition of Zero-coupon bonds. Noun 1. zero-coupon bond - a bond that is issued at a deep discount from its value at maturity and pays no interest during the life of the bond; the...

Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don’t mature for ten, fifteen, or more years. …

zero coupon bonds definition and meaning | AccountingCoach zero coupon bonds definition. A bond without a stated interest rate. Because no interest is paid, the bond will sell for a discount from its maturity value. Rather than receiving interest, an investor's compensation will be the difference between the discounted price at which the bond was purchased and the price the investor receives when selling the bond.

Zero-coupon bonds financial definition of Zero-coupon bonds A zero-coupon bond is issued at a fraction of its par value (perhaps at $3 to $5 for each $100 of face value for a long-term bond) and increases gradually in value as it approaches maturity. Thus, an investor's income from a zero-coupon bond comes solely from appreciation in value. Zero-coupon bonds are subject to very large price fluctuations.

Zero Coupon Bond | Definition, Formula & Examples - Study.com The zero-coupon bond definition is a financial instrument that does not pay interest or payments at regular frequencies (e.g. 5% of face value yearly until maturity). Rather, zero-coupon bonds...

Corporate Bonds: Meaning, Features and Benefits - BondsIndia Bonds having a credit rating of AAA to BBB are considered as Investment Grade Bond, others are considered as Non-investment Grade Bond. Coupon rate: Corporate bonds have higher coupon rates than G-secs. Normally, corporate bonds provide 7% (AAA rated) to 12% (A rated) coupons in the current year 2021. On the contrary, G-secs provide a 6% coupon ...

Bond Definition: What Are Bonds? – Forbes Advisor 24.08.2021 · Zero-Coupon Bonds: As their name suggests, zero-coupon bonds do not make periodic interest payments. Instead, investors buy zero-coupon bonds at a discount to their face value and are repaid the ...

Zero-coupon bond financial definition of Zero-coupon bond Zero-Coupon Bond A bond that pays no interest. It is sold at a discount from par and matures at par. These are fairly illiquid investments because they do not benefit from changes in interest rates. However, they tend to be low- risk. Zero-coupon bonds fluctuate in price, sometimes dramatically, with changes in interest rates.

What Is a Zero-Coupon Bond? Definition, Characteristics & Example Like regular bonds, zero-coupon bonds are financial securities that mature over time, and their face (par) value is paid to their holder at the end of their term. Unlike coupon-paying bonds,...

Post a Comment for "43 zero coupon bonds definition"