38 calculate price zero coupon bond

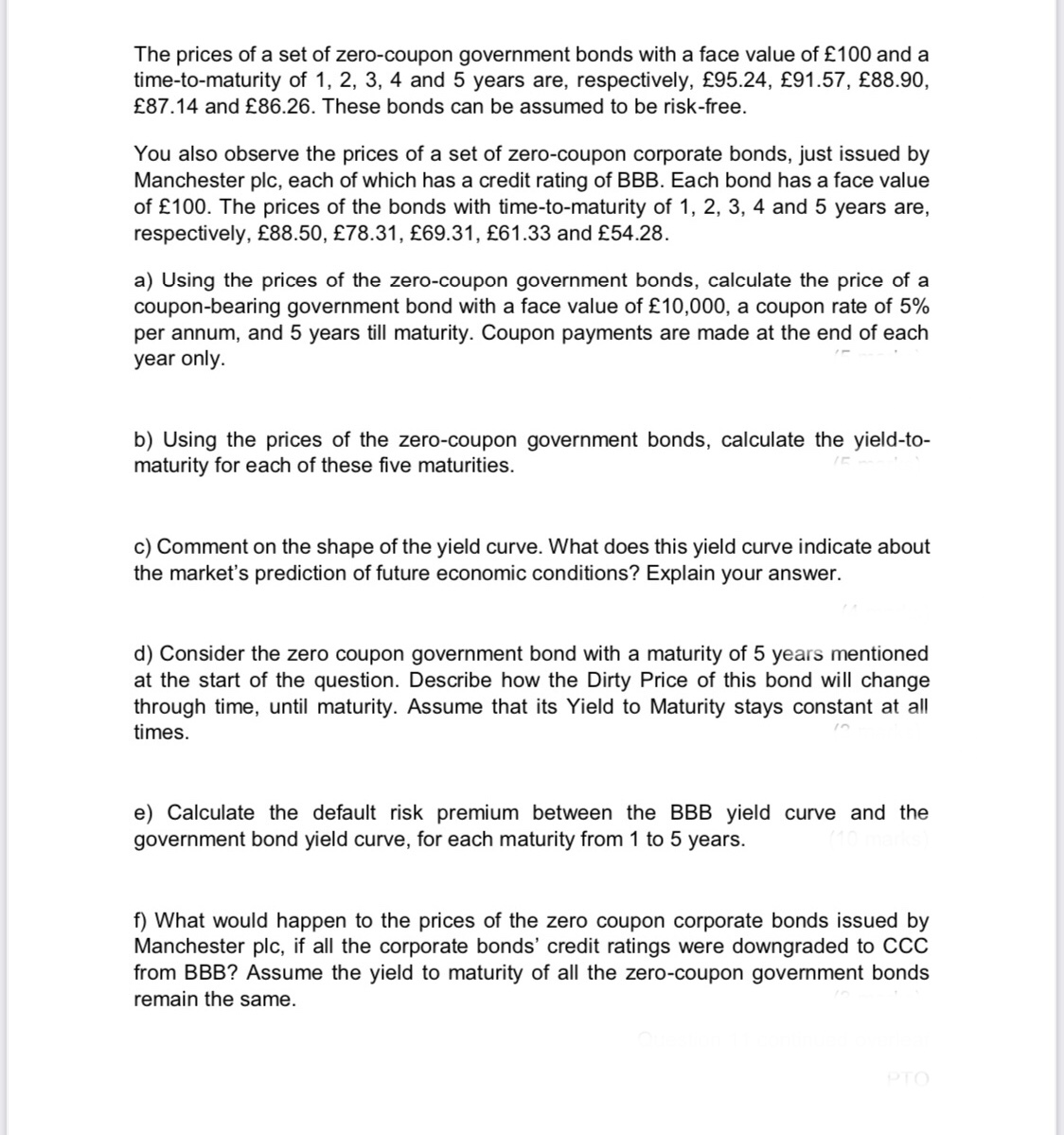

Calculate Zero-coupon Bond Purchase Price Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. Raise 2 to the 1/30th power ... Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator Mar 24, 2021 ... Zero-Coupon Bond Value Formula · M = maturity value or face value of the bond · r = rate of interest required · n = number of years to maturity.

Zero Coupon Bond | Definition, Formula & Examples - Study.com Feb 18, 2022 ... The basic method for calculating a zero coupon bond's price is a simplification of the present value (PV) formula. The formula is price = M / (1 ...

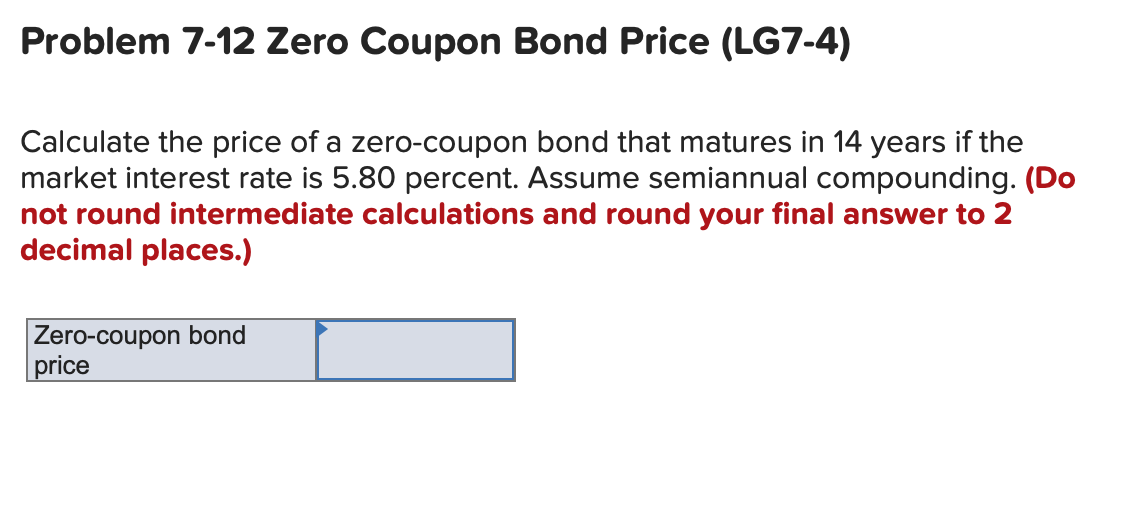

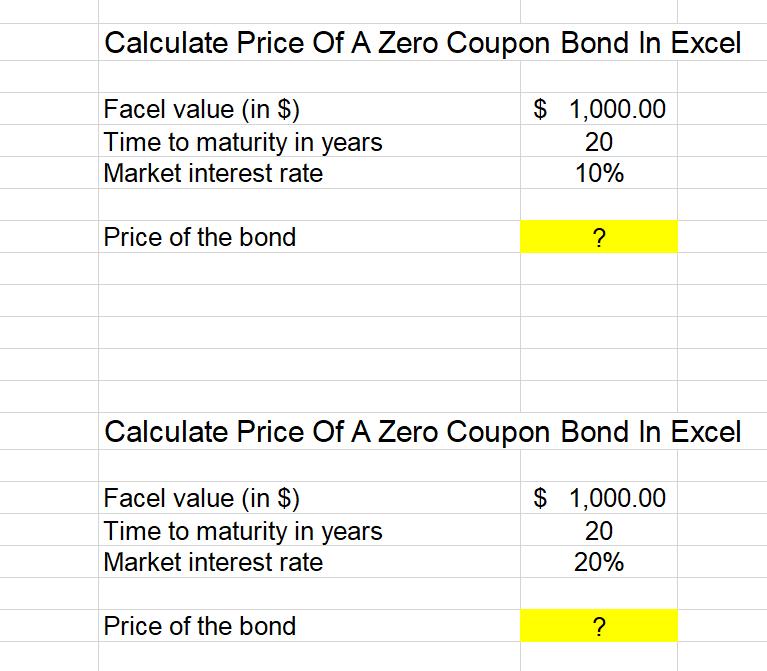

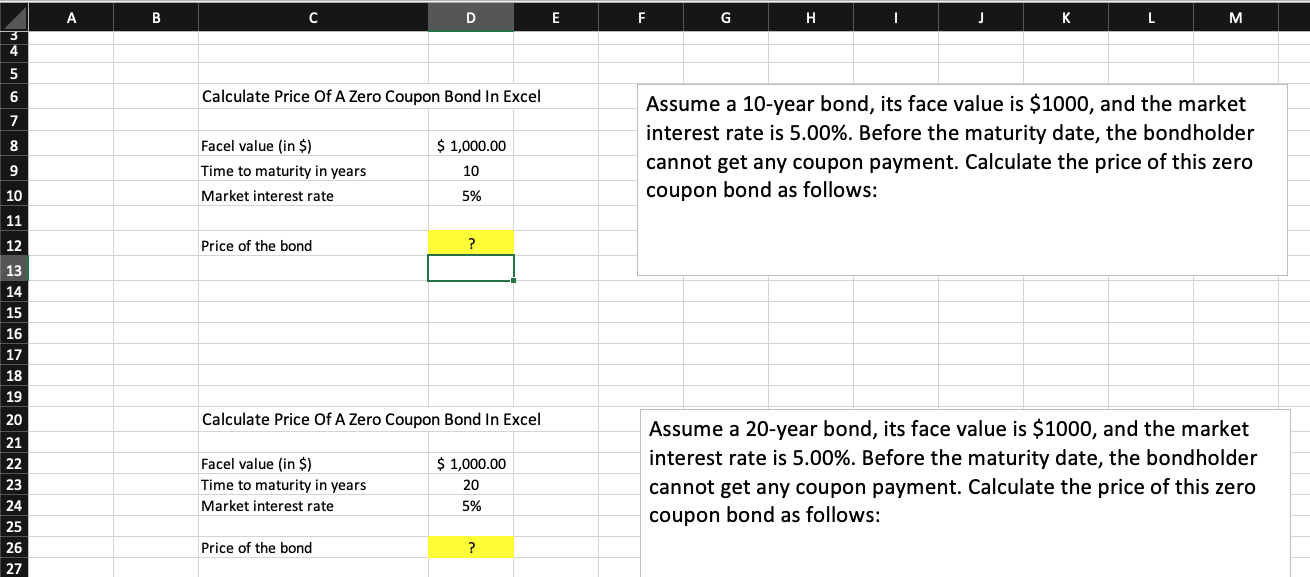

Calculate price zero coupon bond

Zero-Coupon Bond - Definition, How It Works, Formula Oct 26, 2022 ... As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value ... Zero Coupon Bond Value Calculator - BuyUpside.com The calculator, which assumes semi-annual compounding, uses the following formula to compute the value of a zero-coupon bond: Value = Face Value / (1 +Yield ... Zero-Coupon Bond: Definition, How It Works, and How To Calculate Pricing a Zero-Coupon Bond · M = Maturity value or face value of the bond · r = required rate of interest · n = number of years until maturity.

Calculate price zero coupon bond. Zero Coupon Bond Value - Financial Formulas (with Calculators) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. Zero-Coupon Bonds: Characteristics and Calculation Example Zero-Coupon Bond ; Formula · PV = Present Value; FV = Future Value; r = Yield-to-Maturity (YTM) ; Model Assumptions. Face Value (FV) = $1,000; Number of Years to ... Zero Coupon Bond Calculator – What is the Market Value? - DQYDJ Zero Coupon Bond Calculator Inputs · Bond Face Value/Par Value ($) - The face or par value of the bond – essentially, the value of the bond on its maturity date. Zero Coupon Bond - Explained - The Business Professor, LLC Apr 17, 2022 ... Unlike the regular, coupon-paying bonds, a zero-coupon bond has an imputed interest rate (rather than an established interest rate). To ...

Zero-Coupon Bond: Definition, How It Works, and How To Calculate Pricing a Zero-Coupon Bond · M = Maturity value or face value of the bond · r = required rate of interest · n = number of years until maturity. Zero Coupon Bond Value Calculator - BuyUpside.com The calculator, which assumes semi-annual compounding, uses the following formula to compute the value of a zero-coupon bond: Value = Face Value / (1 +Yield ... Zero-Coupon Bond - Definition, How It Works, Formula Oct 26, 2022 ... As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value ...

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "38 calculate price zero coupon bond"