40 yield to maturity coupon bond

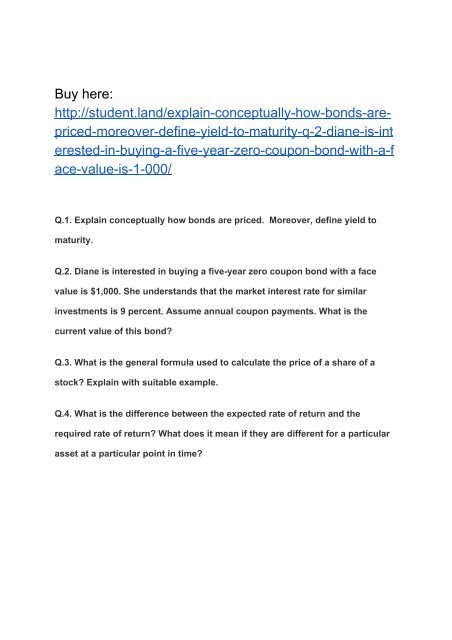

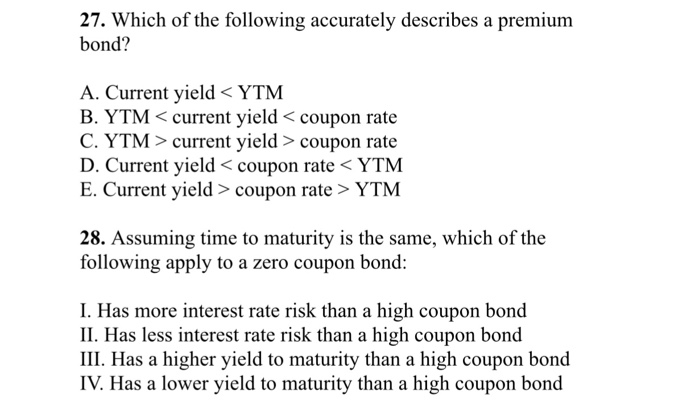

Current Yield vs. Yield to Maturity - Investopedia Bond Yield As a Function of Price . When a bond's market price is above par, which is known as a premium bond, its current yield and YTM are lower than its coupon rate.Conversely, when a bond ... Learn to Calculate Yield to Maturity in MS Excel - Investopedia Suppose the coupon rate on a $100 bond is 5%, meaning the bond pays $5 per year, and the required rate—given the risk of the bond—is 5%. Because these two figures are identical, the bond will ...

› ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ...

Yield to maturity coupon bond

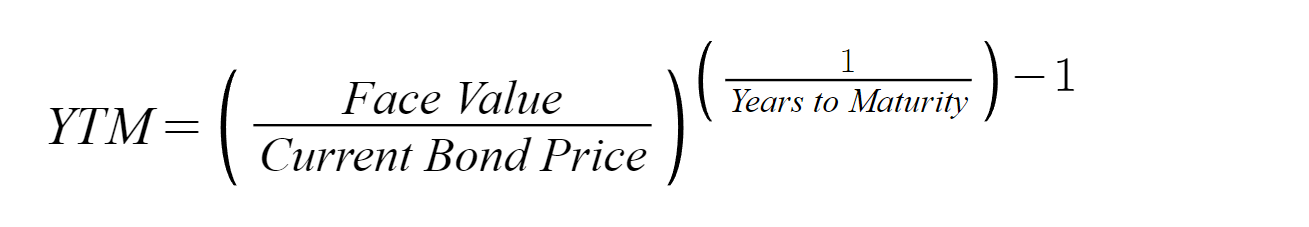

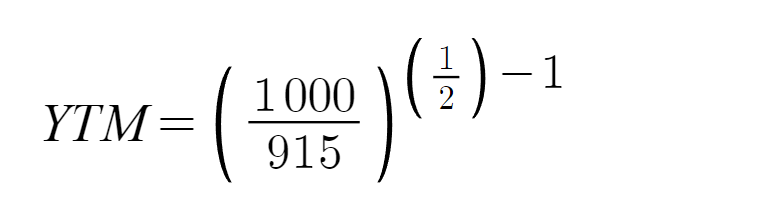

When is a bond's coupon rate and yield to maturity the same? - Investopedia Vikki Velasquez. A bond's coupon rate is equal to its yield to maturity if its purchase price is equal to its par value. The par value of a bond is its face value, or the stated value of the bond ... How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia Zero-Coupon Bond Formula. The formula for calculating the yield to maturity on a zero-coupon bond is: Yield To Maturity=(Current Bond PriceFace Value)(Years to Maturity1) −1. Yield To Maturity Coupon Bond - bizimkonak.com Yield to Maturity (YTM) - Definition, Formula, Calculation … CODES (1 days ago) The current yield of bond= Annual coupon payment/current market price read more, which measures the present value of the bond, the yield to maturity measures the value of the bond at the end of its bond term. In other words, a … Visit URL. Category: coupon codes Show All Coupons

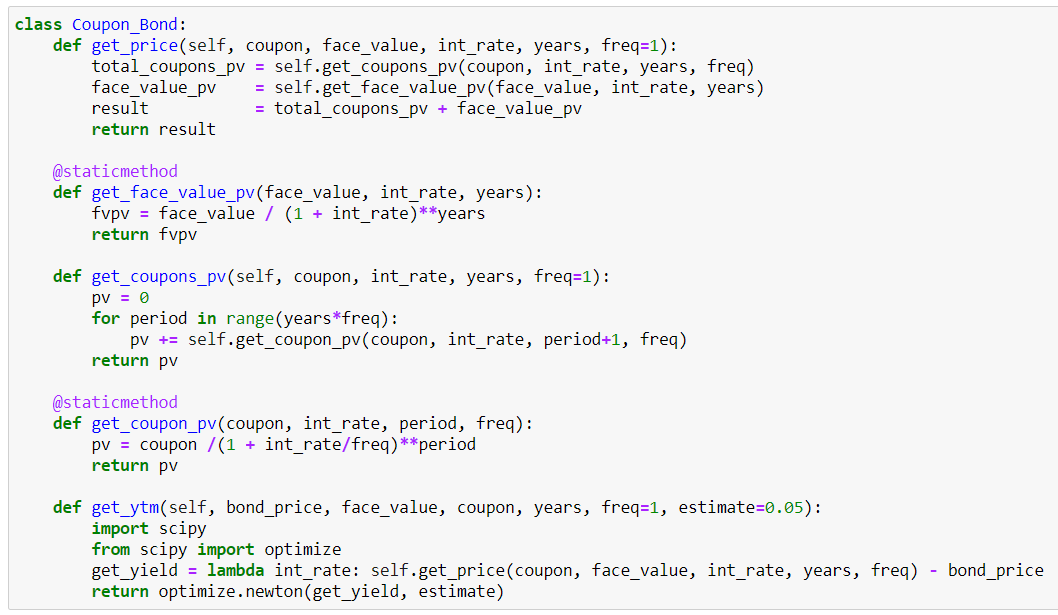

Yield to maturity coupon bond. Yield to Maturity Calculator | Calculate YTM Determine the annual coupon rate and the coupon frequency. coupon rate is the annual interest you will receive by investing in the bond, and frequency is the number of times you will receive it in a year. In the yield to maturity calculator, you can choose from six different frequencies, from annually to daily. In our example, Bond A has a ... Yield to Maturity (YTM) Definition & Example | InvestingAnswers The yield to maturity is the percentage of the rate of return for a fixed-rate security should an investor hold onto the asset until maturity. The coupon rate is simply the amount of interest an investor will receive. Also known as nominal yield or the yield from the bond, the coupon rate doesn't change. Simply put, it is the total value of ... en.wikipedia.org › wiki › Yield_to_maturityYield to maturity - Wikipedia Formula for yield to maturity for zero-coupon bonds = ... Suppose that over the first 10 years of the holding period, interest rates decline, and the yield-to-maturity on the bond falls to 7%. With 20 years remaining to maturity, the price of the bond will be 100/1.07 20, or $25.84. Even though the yield-to-maturity for the remaining life of ... Yield to Maturity (YTM) - Overview, Formula, and Importance On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity

What is the yield to maturity for a 3 year bond with a 10% annual ... A bond's yield is equal to its coupon when it trades at par. For the risk of lending money to the bond issuer, investors anticipate receiving a return equivalent to the coupon. Therefore the yield of maturity will be 10% itself , Option C is the right answer. Basics Of Bonds - Maturity, Coupons And Yield - InCharge Debt Solutions Current yield is the bond's coupon yield divided by its market price. To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010). › terms › yYield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... en.wikipedia.org › wiki › Bond_(finance)Bond (finance) - Wikipedia In finance, a bond is a type of security under which the issuer owes the holder a debt, and is obliged – depending on the terms – to repay the principal (i.e. amount borrowed) of the bond at the maturity date as well as interest (called the coupon) over a specified amount of time. The interest is usually payable at fixed intervals ...

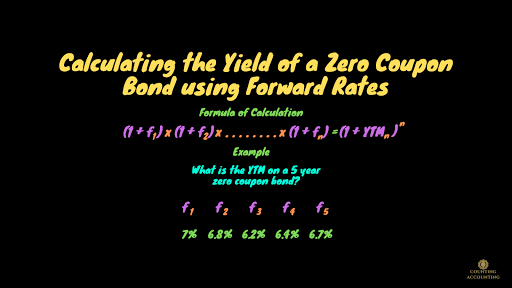

dqydj.com › bond-yield-to-maturity-calculatorBond Yield to Maturity (YTM) Calculator - DQYDJ Yield to Maturity of Zero Coupon Bonds. A zero coupon bond is a bond which doesn't pay periodic payments, instead having only a face value (value at maturity) and a present value (current value). This makes calculating the yield to maturity of a zero coupon bond straight-forward: Yield to Maturity (YTM): Formula and Calculator - Wall Street Prep The Yield to Maturity (YTM) represents the expected annual rate of return earned on a bond under the assumption that the debt security is held until maturity. From the perspective of a bond investor, the yield to maturity (YTM) is the anticipated total return received if the bond is held to its maturity date and all coupon payments are made on ... How to Calculate Yield to Maturity: 9 Steps (with Pictures) - wikiHow F = the face value, or the full value of the bond. P = the price the investor paid for the bond. n = the number of years to maturity. 2. Calculate the approximate yield to maturity. Suppose you purchased a $1,000 for $920. The interest is 10 percent, and it will mature in 10 years. The coupon payment is $100 ( ). › articles › economicsThe Predictive Powers of the Bond Yield Curve - Investopedia Jun 29, 2022 · A two-year bond could offer a yield of 6%, a five-year bond of 6.1%, a 10-year bond of 6%, and a 20-year bond of 6.05%. Such a flat or humped yield curve implies an uncertain economic situation.

Important Differences Between Coupon and Yield to Maturity - The Balance Coupon vs. Yield to Maturity . A bond has a variety of features when it's first issued, including the size of the issue, the maturity date, and the initial coupon. For example, the U.S. Treasury might issue a 30-year bond in 2019 that's due in 2049 with a coupon of 2%. This means that an investor who buys the bond and owns it until 2049 can ...

Yield to Maturity (YTM) - Definition, Formula, Calculation Examples The current yield of bond= Annual coupon payment/current market price read more, which measures the present value of the bond, the yield to maturity measures the value of the bond at the end of its bond term. In other words, a bond's expected returns after making all the payments on time throughout the life of a bond.

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia Coupon Pass: The purchase of treasury notes or bonds from dealers, by the Federal Reserve.

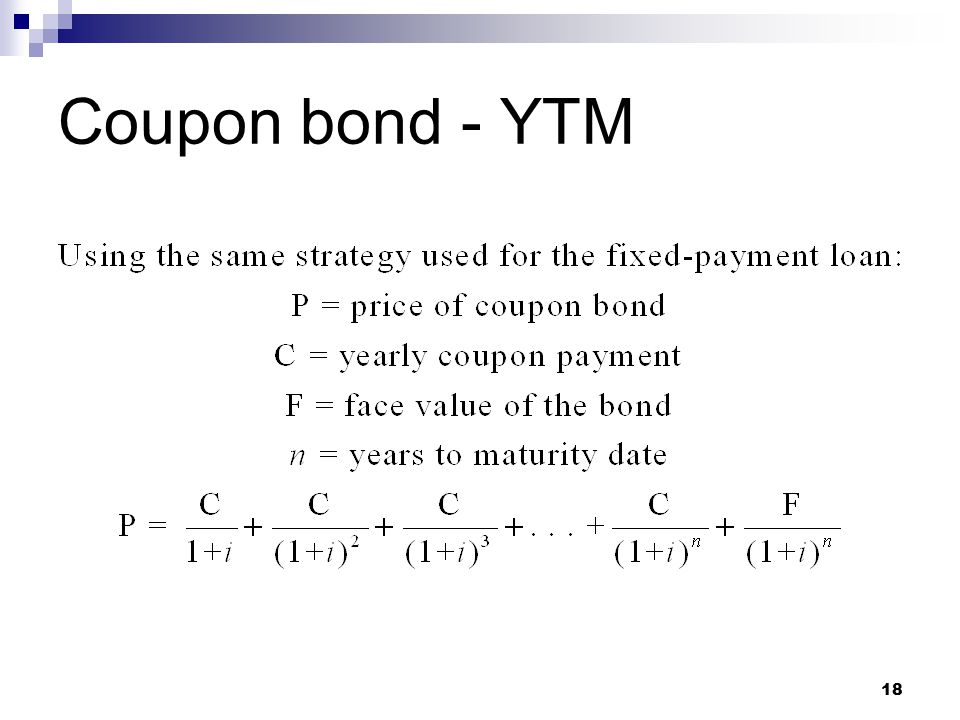

goodcalculators.com › bond-yield-to-maturityYield to Maturity Calculator | Good Calculators P is the price of a bond, C is the periodic coupon payment, r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturity. Example 2: Suppose a bond is selling for $980, and has an annual coupon rate of 6%. It matures in five years, and the face value is $1000. What is the Yield to ...

Understanding Coupon Rate and Yield to Maturity of Bonds Here's a sample computation for a Retail Treasury Bond issued by the Bureau of Treasury: Security Name. Coupon Rate. Maturity Date. RTB 03-11. 2.375%. 3/9/2024. The Coupon Rate is the interest rate that the bond pays annually, gross of applicable taxes. The frequency of payment depends on the type of fixed income security.

Yield To Maturity Coupon Bond - bizimkonak.com Yield to Maturity (YTM) - Definition, Formula, Calculation … CODES (1 days ago) The current yield of bond= Annual coupon payment/current market price read more, which measures the present value of the bond, the yield to maturity measures the value of the bond at the end of its bond term. In other words, a … Visit URL. Category: coupon codes Show All Coupons

How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia Zero-Coupon Bond Formula. The formula for calculating the yield to maturity on a zero-coupon bond is: Yield To Maturity=(Current Bond PriceFace Value)(Years to Maturity1) −1.

When is a bond's coupon rate and yield to maturity the same? - Investopedia Vikki Velasquez. A bond's coupon rate is equal to its yield to maturity if its purchase price is equal to its par value. The par value of a bond is its face value, or the stated value of the bond ...

/dotdash_Final_Yield_to_Worst_YTW_Oct_2020-01-cabc0d0cf5b64ef0b4f72afb4888b3aa.jpg)

Post a Comment for "40 yield to maturity coupon bond"