39 zero coupon bond investopedia

The Basics of Bonds - Investopedia Jul 31, 2022 · Investopedia does not include all offers available in the marketplace. Service. Name. ... What is the difference between a zero-coupon bond and a regular bond? 21 of 28. How Bond Market Pricing Works. Bond Valuation: Calculation, Definition, Formula, and Example May 31, 2022 · Bond valuation is a technique for determining the theoretical fair value of a particular bond. Bond valuation includes calculating the present value of the bond's future interest payments, also ...

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia 31.1.2022 · Unique Advantages of Zero-Coupon U.S. Treasury Bonds . Treasury zeros zoom up in price when the Federal Reserve cuts rates, which helps them to protect stock holdings at precisely the right time.

Zero coupon bond investopedia

How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia 10.10.2022 · Yield to maturity (YTM) tells bonds investors what their total return would be if they held the bond until maturity. YTM takes into account the regular coupon payments made plus the return of ... What does it mean if a bond has a zero coupon rate? - Investopedia Aug 30, 2022 · A bond with a coupon rate of zero, therefore, is one that pays no interest. However, this does not mean the bond yields no profit. Instead, a zero coupon bond generates a return at maturity. Bond: Financial Meaning With Examples and How They Are ... - Investopedia 1.7.2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ...

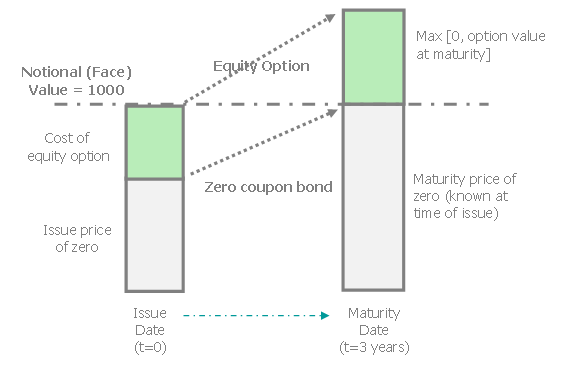

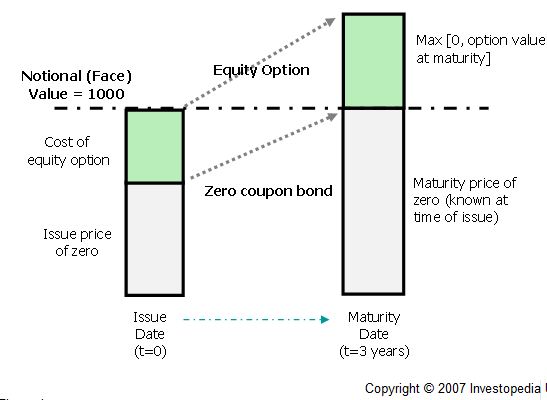

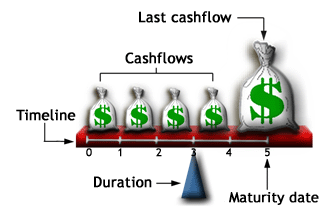

Zero coupon bond investopedia. What Is a Zero-Coupon Bond? - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... Treasury Bonds vs. Treasury Notes vs. Treasury Bills ... - Investopedia 29.3.2022 · Note Auction: A formal bidding process that is scheduled on a regular basis by the U.S. Treasury. Currently there are 17 authorized securities dealers (primary dealers) that are obligated to bid ... What is the difference between a zero-coupon bond and a ... - Investopedia Aug 31, 2020 · A zero-coupon bond does not pay coupons or interest payments like a typical bond does; instead, a zero-coupon holder receives the face value of the bond at maturity. Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · Bond Prices and Yields: An Overview . If you buy a bond at issuance, the bond price is the face value of the bond, and the yield will match the coupon rate of the bond.

Bond: Financial Meaning With Examples and How They Are ... - Investopedia 1.7.2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ... What does it mean if a bond has a zero coupon rate? - Investopedia Aug 30, 2022 · A bond with a coupon rate of zero, therefore, is one that pays no interest. However, this does not mean the bond yields no profit. Instead, a zero coupon bond generates a return at maturity. How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia 10.10.2022 · Yield to maturity (YTM) tells bonds investors what their total return would be if they held the bond until maturity. YTM takes into account the regular coupon payments made plus the return of ...

:max_bytes(150000):strip_icc()/terms_b_bond-yield_FINAL-3ab7b1c73e8b487a9e860f0a5ca6dd6b.jpg)

:max_bytes(150000):strip_icc()/COMPOUNDINTERESTFINALJPEGcopy-f248781269194135aa6044e088de7af9.jpg)

/low-angle-view-of-modern-office-buildings-skyscrapers-in-manhattan-midtown--new-york-1066278582-893bafb325f1449b8845b9d13b807c9d.jpg)

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

:max_bytes(150000):strip_icc()/GettyImages-183367591-9f457266c3734eb6bb07e4ad05e5f2be.jpg)

:max_bytes(150000):strip_icc()/close-up-of-multiple-savings-bonds-1059310052-7a0dd99c399b45f0bc0e91ae253f1423.jpg)

/GettyImages-1169665828-e5e668e6aa454b60b5d06e110711eff3.jpg)

/GettyImages-551987971-41276ca6a78044ab857859bb9f4e0ac1.jpg)

:max_bytes(150000):strip_icc()/GettyImages-597139701-d3b44a08d65844a89c458a6ed9950100.jpg)

:max_bytes(150000):strip_icc()/OPTIONSBASICSFINALJPEGII-e1c3eb185fe84e29b9788d916beddb47.jpg)

:max_bytes(150000):strip_icc()/GettyImages-983195940-6d4c5099c3314718a5ba16c33205d071.jpg)

Post a Comment for "39 zero coupon bond investopedia"